Tobacco use increases extreme poverty in Mexico. About one million Mexicans—who would not otherwise fall below the official poverty line due to their income level—are unable to cover their basic needs due to tobacco spending.

Public policies that reduce tobacco consumption not only produce health benefits but also decrease poverty, helping people to lead longer, more productive lives.

Increasing tobacco taxes that raise the retail prices of tobacco products reduces tobacco consumption and yields long-term economic benefits. The additional revenue generated from higher tobacco taxes could be used to fund both tobacco control and anti-poverty policies.

Introduction1

According to the National Council for the Evaluation of Social Development Policy (CONEVAL), individuals with annual income lower than MXN 20,567 are unable to meet their basic needs and therefore live in urban extreme poverty2. When households spend part of their income on tobacco, less money is available to meet their basic needs. Tobacco consumption impacts a household’s disposable income in four ways:

- Direct spending on tobacco

- Costs associated with treating tobacco-related

- Loss of productivity and work due to health problems associated with smoking; and

- Premature death, which reduces a household’s future

If a household is near the poverty threshold, tobacco expenditure may cause the remaining disposable income to fall under this threshold, driving the household into poverty.

Data and results

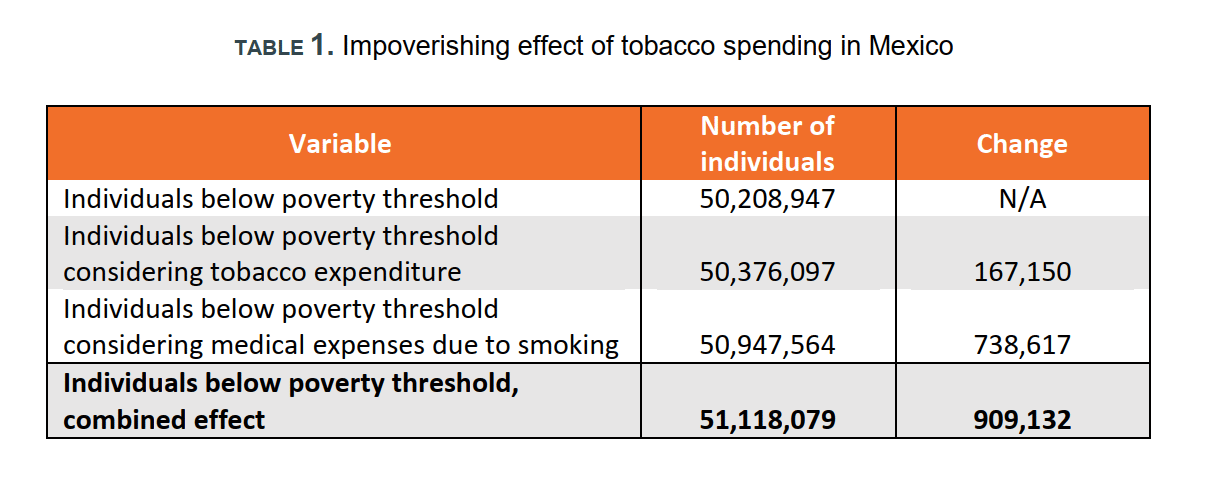

According to the 2020 National Survey of Household Income and Expenditure (ENIGH), 50,208,947 people live below the extreme urban poverty line in Mexico. Direct spending on tobacco products pushes 167,150 Mexicans into extreme urban poverty. Taking into account the medical expenses that can be attributed to smoking (the second effect by which tobacco use reduces disposable income) the number of individuals living below the extreme urban poverty threshold increases by 738,617. The combined effect of direct spending on tobacco and related medical expenses results in a total of 909,132 people driven below the extreme urban poverty threshold by smoking. These results are shown in Table 1.

Public policy implications

Smoking affects not only health but also family finances. In Mexico, nearly one million people are pushed into poverty by smoking and are thus prevented from meeting their basic needs.

Against this backdrop, Mexico needs policies aimed at reducing both tobacco consumption and poverty to prevent more households from falling victim to the impoverishing effect of smoking, which jeopardizes their future quality of life.

If tobacco taxes are increased significantly, they can drive down consumption—by reducing the number of smokers—as well as providing a new source of revenue that can be allocated to help fund the implementation of tobacco control and anti-poverty policies.